SILO Finance Research

SILO Finance : Permissionless & Isolated Lending Market

Silo creates secure and efficient money markets for all token assets through a permissionless, risk-isolating lending protocol.

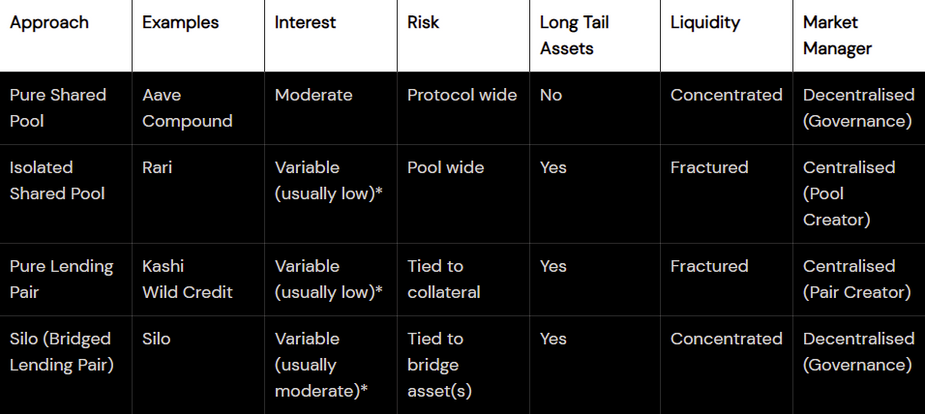

Shared-pool lending protocols (Aave, Compound) are only as strong as their weakest collateral. As the collateral is shared among tokens and pools, exploiting a single token puts the entire protocol at risk.

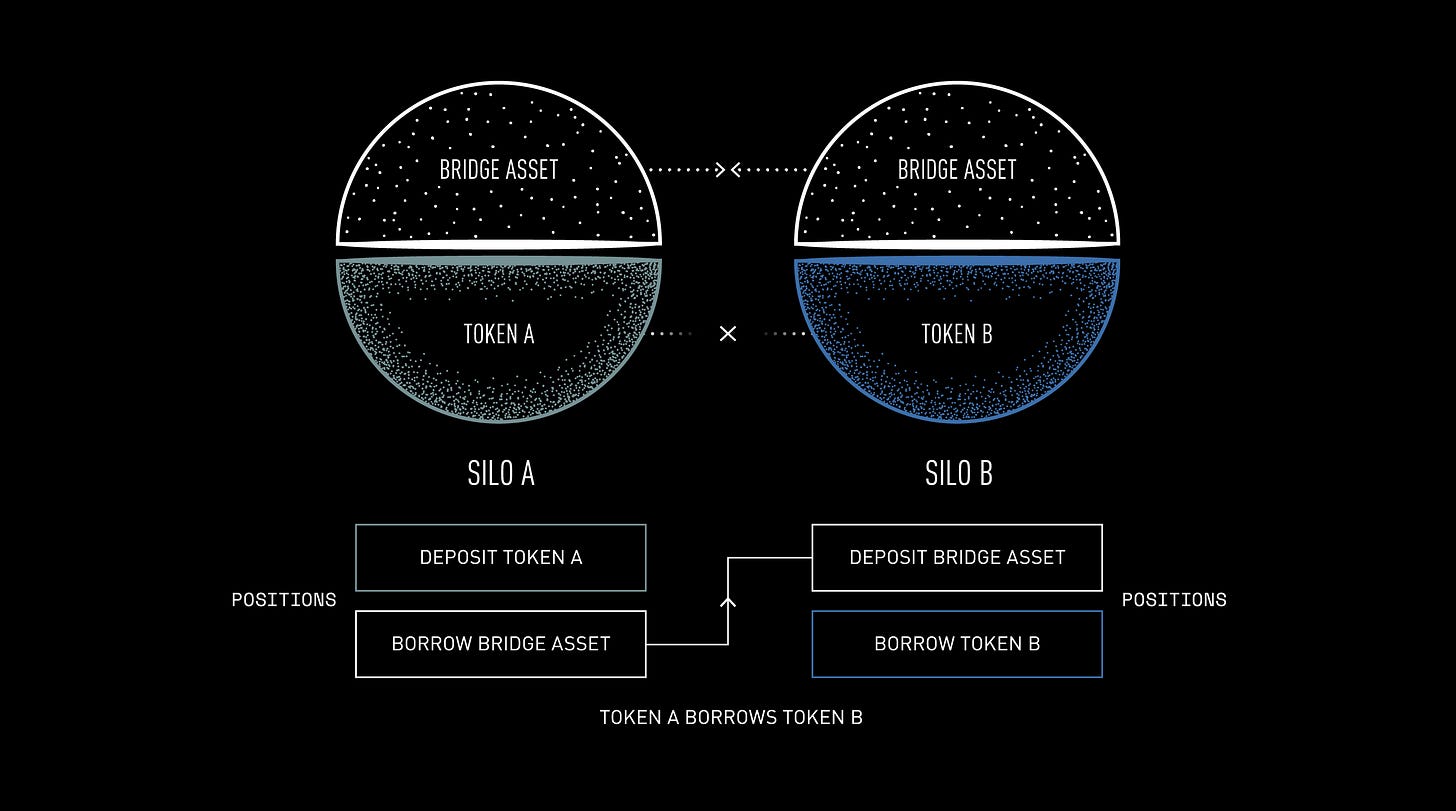

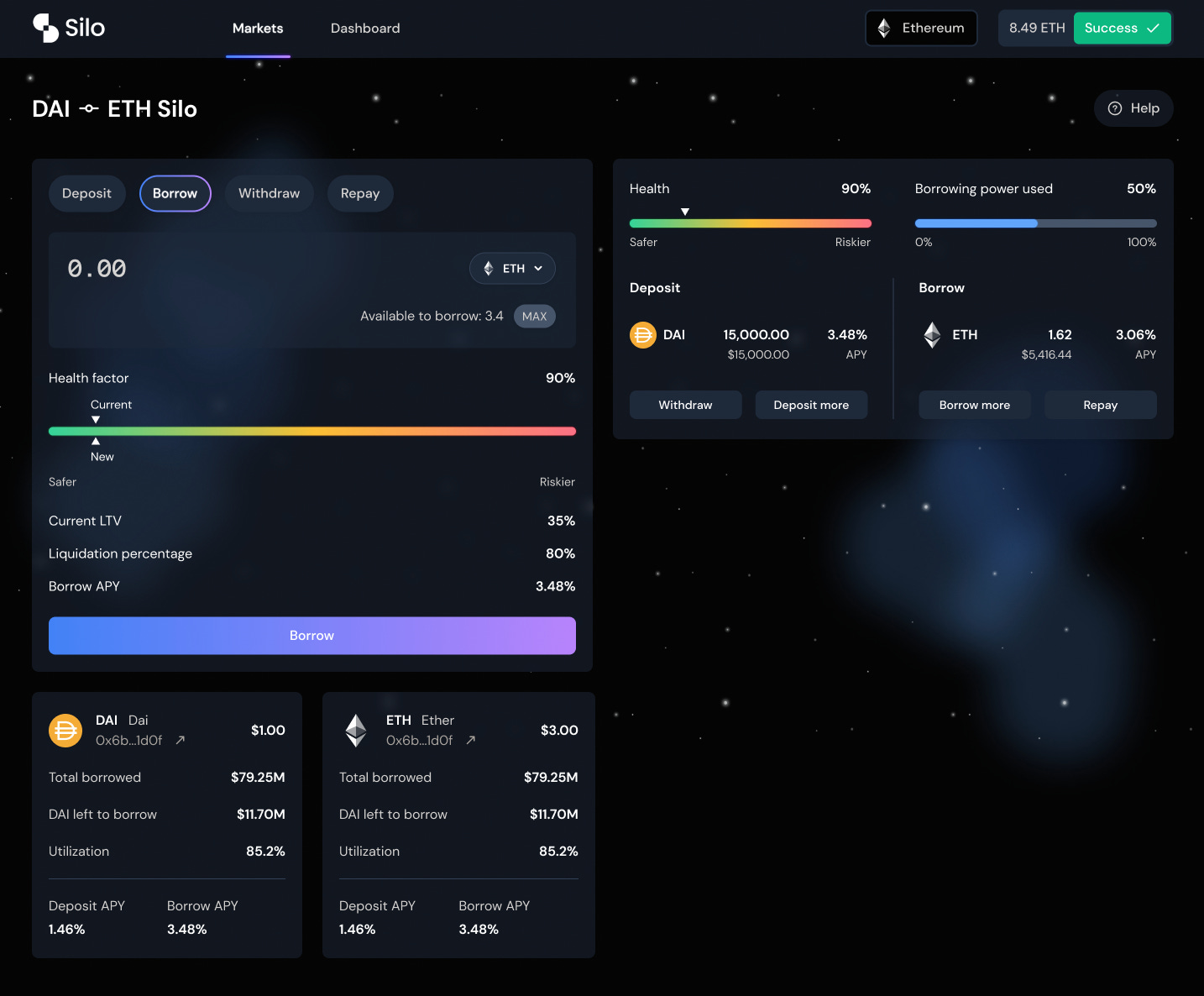

Silo Finance creates isolated “Silos” supporting 2 assets (Bridged Asset) and a unique token. The Bridge asset is the collateral (e.g ETH, SiloUSD) which connects all assets in the protocol.

Shared-pool lending protocols achieve safety with rigid risk policies that account for factors such as liquidity, centralization, and volatility of the token being considered as collateral. This allows only a small number of tokens to be utilized for lending/borrowing. Silos isolated pools allow for ANY token to be used for lending/borrowing. This process is permissionless and anyone with a connected wallet can create a lending market.

Benefits:

1. Isolating risk to single pools

2. Permissionless borrowing/lending of any asset (listed on uniswap or balancer)

Drawbacks:

Aave: Borrow limit 80%, liquidation threshold 85%

Silo: Borrow limit 50%, liquidation threshold 62.5%

Tokenomics:

SILO:

$SILO is the governance token. $SILO gives token holder a say in the future of the protocol through voting and delegation rights.

$SILO holders have control over the SILO-DAO Treasury

Silo StableCoin:

Silo is launching a stablecoin, SiloDollar (USDs). This stablecoin will serve as a bridge asset in every Silo alongside ETH.

SiloDollar is made up of a basket of multiple 3rd party stablecoins — such as Frax, DAI, LUSD, UST, etc. The approved stablecoins are deposited into a pool on one of the major AMMs — a Curve Gauge or a Balancer stable pool to name a few options.

Depositors receive an LP claim token, representing their ownership in the pool, that can be deposited into the SiloDollar minter to mint SiloDollars. Holders of SiloDollars may redeem their SiloDollars at any time and receive $1 of the LP token minus a 0.85% redemption fee, which will accrue to SiloDAO. This redemption fee is implemented to encourage the development of organic liquidity for SiloDollars rather than frequent minting and redemptions.

StableCoins are chosen via auction. Stablecoins can bribe too be included in the stablecoin basket (SiloDAO will approve stablecoin projects in advance). This is biweekly and proceeds go to the SiloDAO.

The Silo DAO:

SiloDAO Votes on the following:

Increasing token supply. This functionality is something the DAO might consider to remove at any point and effectively place a perpetual hard cap on token supply.

Directing the protocol-controlled assets to where it’s beneficial to the growth of the protocol.

Turning on/off DAO’s revenue mechanisms.

Adjusting collateral factors such as LTV and Liquidation Threshold for each Silo.

Approving important product milestones.

SiloDAO accrues value through:

Borrowing premiums: difference between borrowing rate and lending rate which can be paid to treasury. Note that the greater the premium, the less competitive our APY which has implications for TVL.

Liquidation fees: portion of liquidation penalty distributed to SiloDAO.

SiloDollar Bribes; 3rd Party Stable coins can bribe to be included in the SiloDollar basket (if approved by SiloDAO)

0.85% redemption fee for redemption of SiloDollar

Allocation of vlCVX voting power to Votium to collect bribes and expand treasury

SiloDAO holdings:

2,043,665 USDC

250,000 CVX (8,588,070 USDC)

897 ETH (2,842,060)

Total SILO DAO value: $13,474,248

A Tokenomic Thesis:

The maturation of crypto markets has lead to sophisticated Tokenomic systems. Protocols can no longer create “Governance Tokens” with no use-case, and the ones that have are struggling in a revenue based market unless they can adapt (yearn, ect).

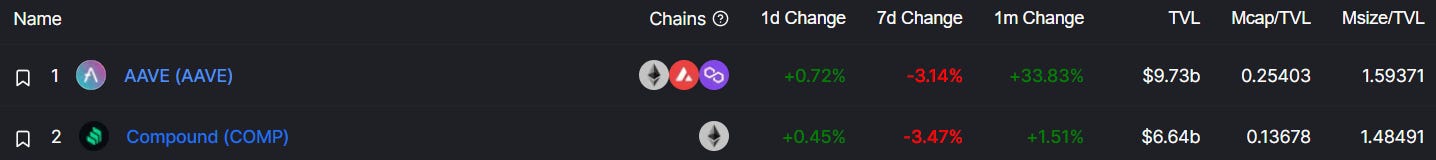

AAVE $598→$179 (70% from ATH) ; AAVE TVL $30b→$22b (25% decrease)

COMP $850→$135 (85% from ATH) ; COMP TVL $20b→$9b (55% decrease)

While DEXes have adapted to the new narratives with VE tokens, Revenue Sharing Models, Defi Lending Protocols have been slow. With Lending platforms lagging behind, $SILOs stablecoin, veSILO model, Revenue sharing, POL, and Bribe system present an extremely attractive investment opportunity.

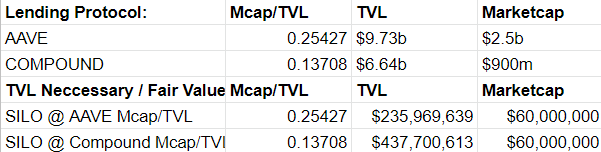

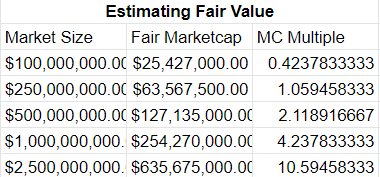

Valuing SILO

To justify a $60M Marketcap, SILO protocol requires $235-437m in TVL. Given the $SILO tokenomics a comparison to AAVE/COMP; the Mcap/TVL is extremely conservative.

While Aave/Compound have limited Collateral Options (22 WL tokens), it can be assumed SILO has a competitive advantage as every ecr20 token on uniswap is eligible for collateral/borrowing.

SILO will offer attractive incentives for bridge Asset providers. The Opportunity to earn Yield on stablecoins with isolated risk ( Limited to Silo pair), will bring high TVL to the SILO platform.

Distribution:

Public sale 12th december. $0.402 average price, 1,340 Participants (https://dune.xyz/spooky/Silo-Auction-Statistics)

Warning: Public Investor bought 30m $SILO, dumped after Public sale. Still has 29m left (https://etherscan.io/token/0x6f80310ca7f2c654691d1383149fa1a57d8ab1f8?a=0x23a5efe19aa966388e132077d733672cf5798c03)

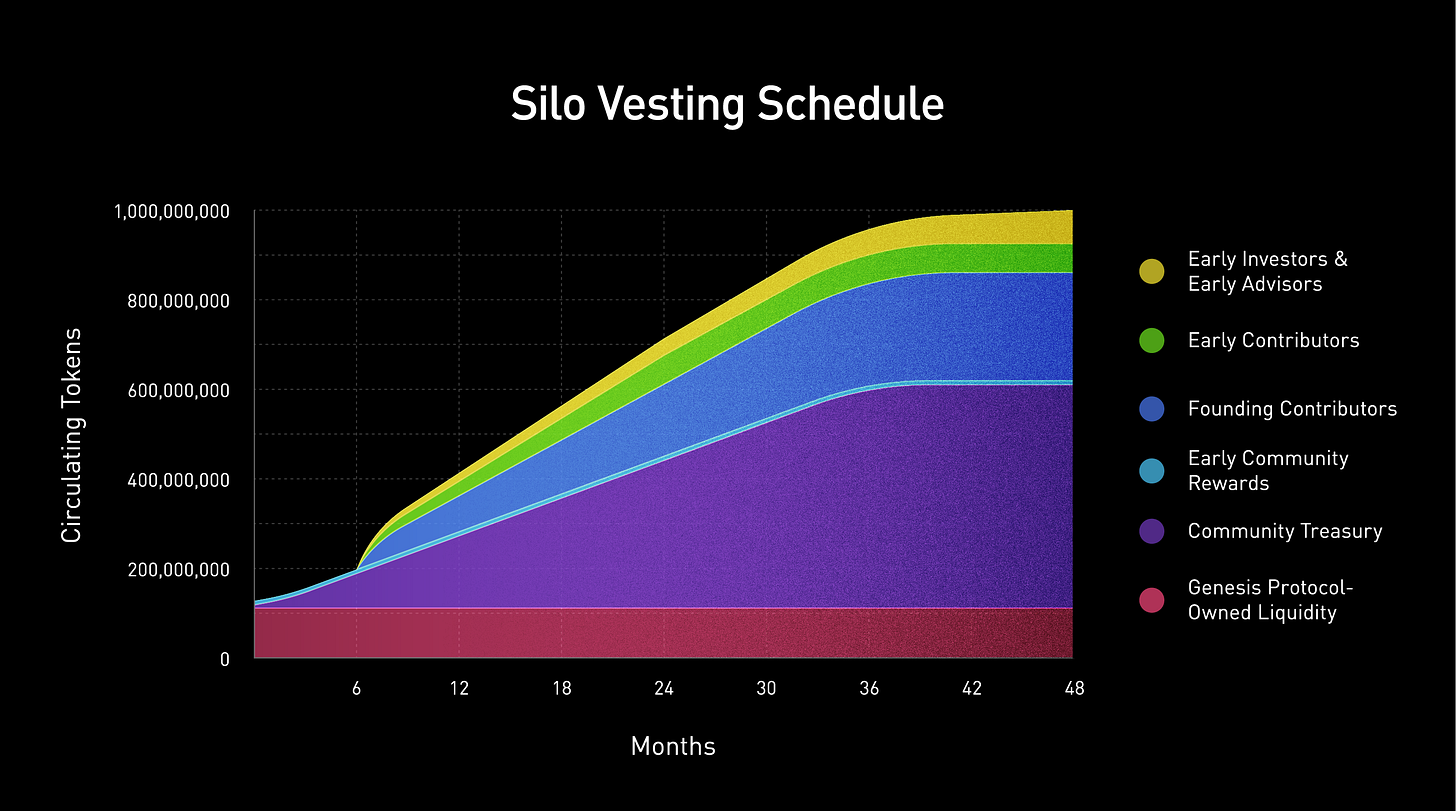

Possible Token Inflation: From June 12th (6 months after TGE), Monthly inflation increases from 12500000 SILO, to 21062500 SILO. 70% Increase in emissions (Which do NOT go to community).

VC funding (Joey Santoro from FEI Protocol, Sam Kazemian from Frax, Santiago R Santos, Ameen from Reflexer, Tyler Ward from BarnBridge, Regan Bozman from Lattice, Sherwin Lee and Keith from PSP Soteria, AiRTX from 0xVentures, Don Ho and Quantstamp, Emile from XDEFI, ShapeShift DAO). No information on VC price.

Bullish Catalyst/Narrative:

Mainnet Release:

Phase 1: Guarded beta ( 60 days)

USDC-ETH, WBTC-ETH, USDT-ETH, DAI-ETH, Frax-ETH SILO

Decrease TVL requirements (Current=100M TVL on uniswap) % Weekly

Focus on Security ( Audits, 5-10m insurance)

Phase 2: Growth

WL certain Silos, Remove TVL caps

Launch Silo tokenomics

Curve Wars Narrative:

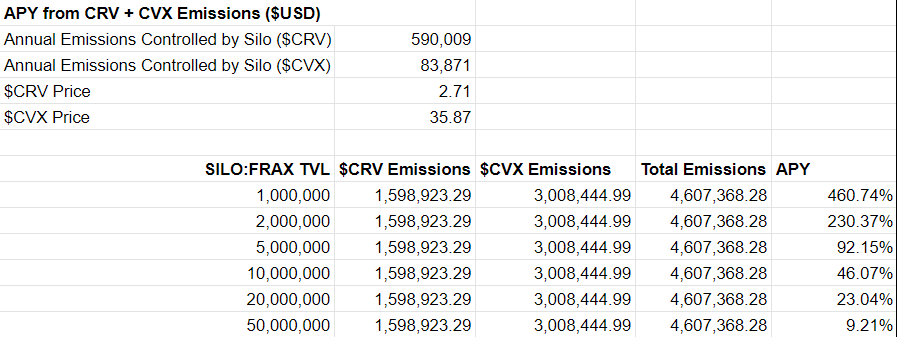

4/21: SILO will vote with 250k CVX to incentives a $FRAX-$SILO POOL

Current Curve Factory Pool:

The TVL of SILO/FRAX Pool could 5x ($2m→$10m), and SILO/FRAX would remain the highest APR pool on Curve.

Sneak Peak: